—

HPI Network > HPI - Health Policy Institute > Analyses > Before next macroeconomic stabilisation (pt. I)

Before next macroeconomic stabilisation (pt. I)

Monday, 29. August 2011, 12:05 — Karol Morvay

Macroeconomic stabilisation becomes again a frequent professional and also political theme. That’s why we submit a series of analytical articles oriented on stabilisation of economy and consolidation of public finance. Professional and political elites in SR should have rich experience with stabilisation programs. But each of previous stabilisation operations ran along different circumstances.

Fourth, but anyway unique

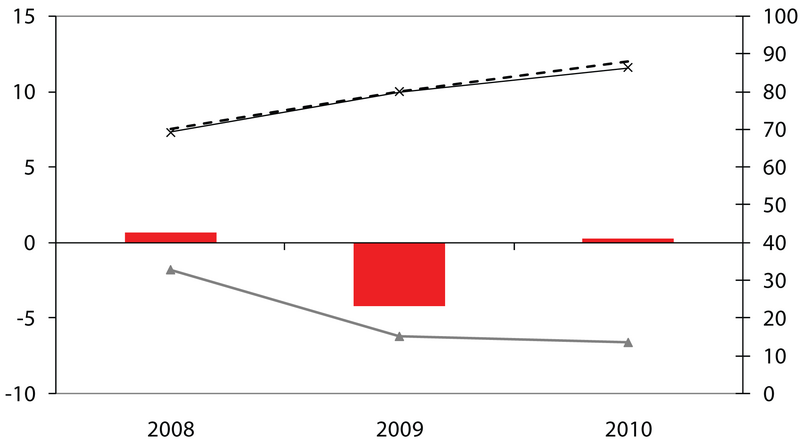

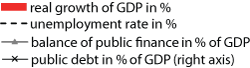

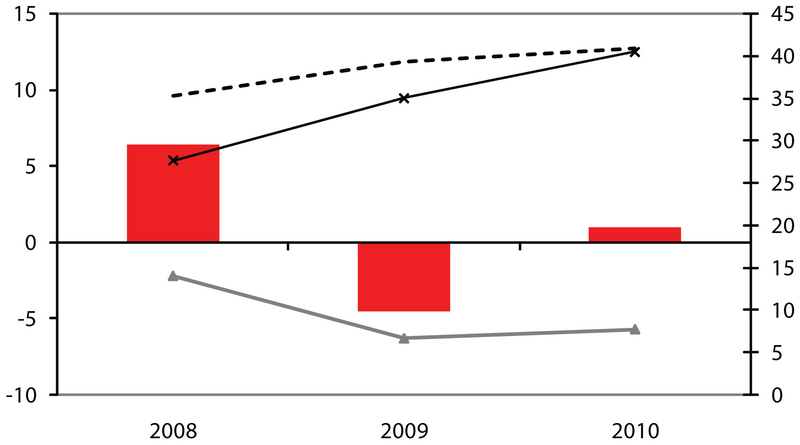

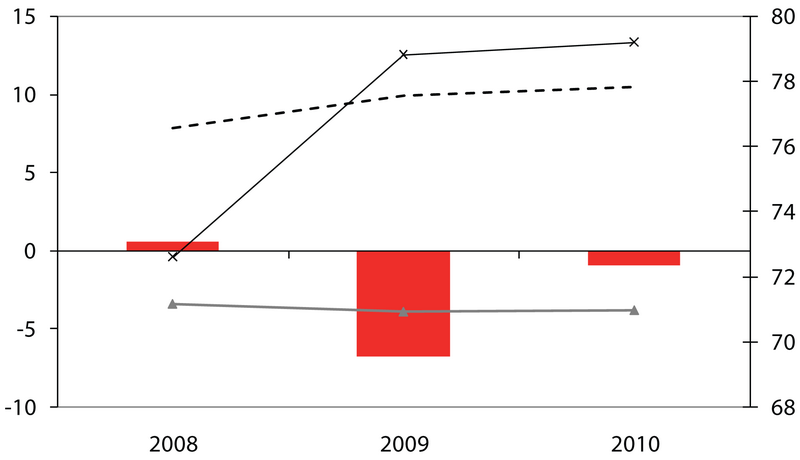

There is nothing surprising on the fact, that economic recession undermined stability (and not only fiscal) of countries. It documents well the October update of IMF World Economic Outlook. It is worth of noticing, that projected data concerning fiscal stability in 2010 compared to 2009 are not improving despite the fact that indicators of economic growth are now substantionally better (in this text we can see it from Chart 1b).

It won’t be a first big macroeconomic stabilisating operation in the history of Slovak economy. It is being prepared a fourth operation of this kind (Table 1). But each of this has original causes and original conditions.

|

Period |

Brief characteristics of stabilising program |

|---|---|

|

1991 – 1993 |

Stabilising program accompanying start of first economic reforms. Stabilising measures should have helped to maintain the domestic demand under control, should have prevented the inflation spiral and expansion of additional uneven states (there was a danger of deficit in foreign trade and also public finance). To this stage we include also the consolidation process connected with the formation of independent state. |

|

1999 – 2000 |

Series of „packages“ of stabilising measures in the state of recidiving macroeconomic unbalance. The effort for maximizing the economic growth with the slide in restructuralisation of economy lead to unacceptable rate of so-called twin deficit (deficit of public finance plus deficit of current account of balance of payments) mainly in years 1996 – 1998. Stabilising program should have enforced macroeconomic balance and give space for further better economic growth. |

|

2004 – 2008 |

It was a stabilising and consolidation program targeted at fulfillment of conditions needed for the adoption of euro. Milder, less dramatic form of stabilising program along with absence of more demanding situations, in conditions of strongly growing economy. |

|

2010 – ? |

Expected stabilising program targeted mainly on fiscal consolidation. Government declares the will in relatively short time to consolidate public finance disrupted by global economic recession. |

Current recession opened the door towards the stronger government intervention. Governments will for sure run to problem: how to consolidate disrupted public finance along with the growth of extent of function of state.

A Slovak specificity is, that government tried also before crises to strenghten the intervention into economy. The crises has „legitimized“ it. In 2010 there will be generated a unique mix of conditions and goals:

- Lasting of some traits of recession (the growth of unemployment rate)

- The effort to enlarge interventions

- The phenomenon of election year

- Guarantee to maintain the social standard

- The intention to consolidate

Despite the forecasted renewal of GDP growth we need to perceive the macroeconomic conditions in the next year with a substantial caution, for example also owing to these reasons:

A better result of development of GDP will be attained to a big extent thanks to very low comparing basis from 2009. We expect, that the recovery will not be straightforward, but rather gradual, fluctuating. Currently it is not a common cyclical downswing in the dynamics of economic activity. Global and also Slovak economy will be recovering by means of innovation and restructuralisation. In view of deeper roots of global recession it should not be a fluent, smooth recovery. It can happen, that the rate of growth of real GDP in 2010 will be surprisingly favorable – more significant than we assume in Graph 1a (or as it assumes Ministry of Finance of SR in Table 2). More significant, more than 3 percent growth of real GDP, forecasts for Slovakia for 2010 for instance IMF (IMF World Economic Outlook, October 2009). For now we suggest from the principle of vigilance to calculate with lower numbers. (Note: If started with third quarter 2009 there will be no quarter-to-quarter decline in seasonally adjusted real GDP until the end of 2010, than the year-to-year change in GDP in 2010 can really be higher than 3%. It is owing to cca 11 percent quarter-to-quarter decline in the first quarter of 2009. Hence it is for sure the problem of base effect.)

| a) Slovakia | b) Eurozone |

|

|

| c) Hungary | d) Czech republic |

|

|

|

|

|

Source: Statistical office of SR, IMF World Economic Outlook (October 2009), Pénzügyminisztérium, OECD Economic Outlook 85 database (June 2009), Ministry of finance of Czech republic and Health Policy Institute

|

2008 |

2009 |

2010 |

2011 |

2012 |

|

|---|---|---|---|---|---|

| Growth of real GDP in % | 6.4 | -5.7 | 1.9 | 4.1 | 5.4 |

| Rate of unemployment in % | 9.6 | 11.7 | 12.1 | 11.6 | 11.0 |

| Balance of public finance in % GDP | -2.2 | -6.3 | -5.5 | -4.2 | -3.0 |

| Public debt in % GDP | 27.6 | 37.1 | 40.8 | 42.5 | 42.2 |

Source: Statistical office of SR (data for 2008) and Ministry of finance of SR: The budget of public administration for 2010 to 2012 confirmed by government of SR

Recovery of growth of production doesn’t need to mean an immediate plunge in the rate of unemployment and even the growth of number of workers. We use following assumptions:

- During significant swings in production in the past (also in the beginning of current recession) the changes in employment usually with delay reacted on changes in dynamics of production (mainly in value added).

- Probably we need to calculate with caution of employers during the hiring of further manpower. On the recovery of growth in demand they will in the first order react by full use of labor force, which they didn’t fully used during the recession (but they didn’t released it). They will probably react with caution to traces of recovering of demand. Only when the dynamics of demand of production will achieve the overtreshold and stabilising rate, we can calculate with the growth of number of workers.

In similar spirit also OECD Employment Outlook warns before negative development on the labor market even after the recovery of production. The rate of unemployment should culminate only in 2010. Hence we need to calculate with the fact, that weight of social system (or the weight of public finance) resulting from expansion of unemployment, will be very probably escalating in 2010.

Government ambition can challenge also its own pitfalls

The budget of public administration for 2010 – 2012 assumes, that already in 2010 will start the process of consolidation of public finance and in 2012 will again be fulfilled the Maastricht criterion for deficit. At the same time should the share of public debt after its upswing to the level 42,5% of GDP start to decline starting with the year 2012 (see in Table 2). Government prognosis and also consolidation intention can hit on following barriers:

- Already mentioned risk of fragile, continuous recovery of global and owing to this also Slovak economy. Transition to relatively high rates of growth of economy even in 2011 (as it anticipates MF SR) doesn’t need to be a matter of course. We warn also before the risk of longer stay on although positive, but not enough attractive values of rate of growth of economy for the period of couple of years. And that should fundamentally slower the consolidation of public finance.

- If the improvement of development on labor market will substantionally delay after improvement of parameters of production, there will arise a pressure on government to support the employment. And the government due to its orientation will have to perceive sensitively the problems of employment. And especially in election year.

- Anti-crisis measures of government were planned to have only temporary validity. But we need to calculate with the pressure from lobbists, for whom the government measures are suitable. There can arise arguments in favor of prolonging of validity of temporary measures. If these arguments will be sufficiently persuasive or supported under pressure, the prolonging of validity of anti-crisis measures can bring additional fiscal weight. Unstandard anti-crisis tools are sometimes hard-to-remove, it is hard to find a boundary, when they should function no more.

- The government has uttered risky guarantee for “maintaining social standard“. There arises an illusion for the pubic, that government can by means of public finance completely protect the citizens in Slovak republic from the social impacts of global recession. Full enforcing of such a guarantee cannot be (and even should not be) in the power of public finance of SR.

- The development of the share of public debt on GDP should not after 2011 change the direction towards more favorable values. As possible we consider also next mild growth of this share. Furthermore there is a risk, that politicians will abuse the “reserve“ between the share of public debt in SR and the value tolerated by the rules of monetary union. Mainly in that time, when the usual value of share of public debt in other countries (and on average in eurozone) will be substantionally higher than in SR (and there is a real threat of such a constellation). It can support the ambitions of politicians to achieve non-adequate goals in economic or social area at the expense of the share of public debt. We need to perceive fiscal parameters including the share of public debt as a factor of competitiveness.

It is interesting that the government has a goal to decrease the share of deficit of public finance even in 2010, when in the data for eurozone (as also Czech republic and Hungary, see in Chart 1) arises even next growth of the share of deficit. If it was possible for the government to enforce this scenario, it would mean a substantial increase in the credibility of its policy and also increasing of competitiveness of economy. In view of sooner mentioned risks (from which a part the government makes on its own) we predict slower progress of fiscal consolidation.

News

The amendment of the Decree on emergency medical service

Health insurance companies returned over 400 thousand €

The HCSA received 1,647 complaints last year

A half million people will earn more

Most of public limited companies ended in the black

Debt of hospitals on premiums has grown to nearly € 105 MM

Slovak health care may miss € 250 million next year

Profits of HIC amounted to € 69 mil. last year

Owners of Dôvera paid out money but did not paid taxes

Like us on Facebook!

Our analyses

- 10 Years of Health Care Reform

- New University Hospital in Bratislava

- Understanding informal patient payments in Kosovo’s healthcare system

- Analysis of waiting times 2013

- Health Policy Basic Frameworks 2014-2016

- Analysis of informal payments in the health sector in Slovakia

- Serbia: Brief health system review

developed by enscope, s.r.o.