—

HPI Network > HPI - Health Policy Institute > Lectures > Cash-flow defines behavior: Capitation (lecture 5/8)

Cash-flow defines behavior: Capitation (lecture 5/8)

Tuesday, 25. June 2013, 16:55 — HPI

Watch the fourth lecture from 8 lectures course running under the title „Innovation for better healthcare” at University for modern Slovakia. In this lecture, Peter Pažitný speaks about the payment mechanisms in the health sector which defines behavior of health care professionals. In this episode, we talk about capitation – payment “per capita”. By this payment mechanism are remunerated mainly general practitioners and outpatient gynecologists. The lecture video includes English subtitles. Transcript together with the all schemas can be found under the video.

1. What is a payment mechanism?

Payment mechanism is a third party payment. It defines how health insurance companies reimburse healthcare providers. At the same time it is an incentive and motivation, which defines providers’ behavior. Payment mechanism can be applied for:

- Existence

- Activity

- Coordination

- Result

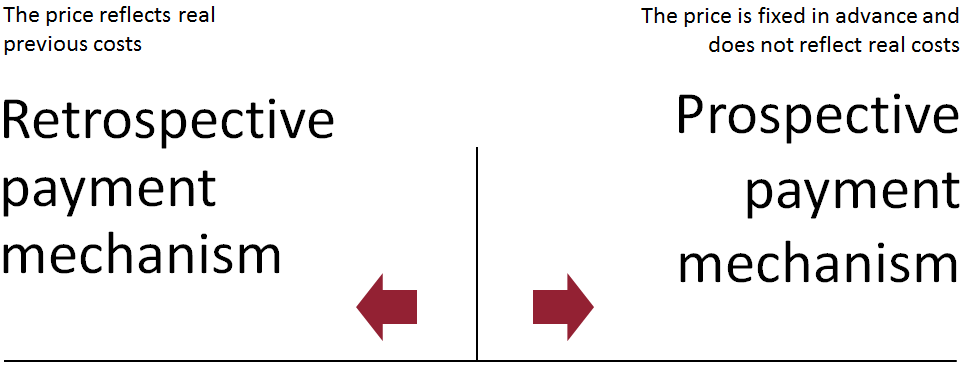

2. Aspect of time

From the aspect of time, we differentiate retrospective and prospective payments mechanisms

Scheme 1: Aspect of time

Source: Prepared by the author

3. What is capitation?

The word capitation originates in Latin „caput“ – head. I am sure you know the expression „per capita“ – per person. Thus, capitation means payment per person. In English literature we may also find an expression PMPM – per member per month. It is a payment „per person per month“.

Healthcare provider receives every month the same amount of money for each person, regardless if the person will or will not utilize healthcare services and how much they will cost.

Capitation started to exist as part of managed care tools in the USA. Health insurance companies transfer some or the whole risk on healthcare providers. At the same time, healthcare providers have the ability and motivation to manage the risk in a more efficient way.

4. What does capitation include?

Capitation includes 3 important aspects:

- Payment is linked to a defined population of insured, i.e. money follows the insured

- Healthcare is prepaid by a predetermined rate (prospective payment mechanism)

- The receiver of capitation has to bear financial risk when the costs exceed payments and therefore he/she is motivated to manage the provided care in a cost efficient way

5. What kind of capitation do we know?

In principle we may differentiate among three types of capitation

|

Capitation type |

What does it cover? |

Who is the receiver? |

Note |

Application in Slovakia |

|---|---|---|---|---|

|

Only services provided by a specific doctor (i.e. simple capitation) |

Only services of specific general practitioners |

Individual doctor |

It is rare, because there is a high risk of cost transfer avoiding the doctor! |

All general practitioners |

|

Capitation for ambulatory services (full physician capitation) |

Covers all services provided by general practitioners and specialists |

A group of general practitioners and specialists |

Within the group, payments are allocated according to a predefined formula |

Does not exist in Slovakia |

|

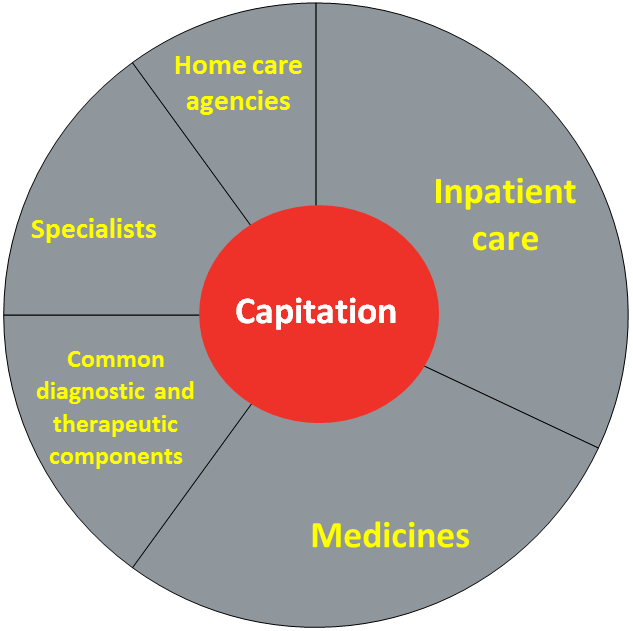

Full risk capitation |

Includes all healthcare services – general practitioners, specialists, inpatient care, medicines etc. |

A group of doctors and hospitals |

There is a need for a large group of insured (approx. 40 000 insured) – very high risk for a single doctor |

Plan MEDIPARTNER in Košice (53 general practitioners) |

Source: prepared by the author based on the presentation of Angelika Szalayová

6. Which type of capitation is applied in Slovakia?

In Slovakia, simple capitation is the most frequently applied type of capitation, which reimburses only the services provided by a specific general practitioner (however, pediatricians and gynecologists are reimbursed in a similar way):

- Capitation makes about 90% of a general practitioner’s income (approx. 2 € per insured, i.e. If there are 1.500 capitated insured, the income may reach 3.000 € per month).

- The rest, 10%, are reimbursements for healthcare services provided (e.g. vaccination).

Simple capitation applied in Slovakia does not include responsibility for induced costs, as well as for specialists‘ services, nor for medicines and inpatient care. Thus, there is a great possibility to transfer costs by avoiding the doctor. Especially, if we realize that capitation makes less than 10% of all costs induced by the general practitioner. What is more, for costs induced in such way, the doctor does not bear any responsibility.

Scheme 2: Capitation makes less than 10% of costs per insured

Source: Prepared by the author

Simple capitation applied in Slovakia does not reimburse general practitioners for:

- activity

- coordination of healthcare services

- results

General practitioners are not reimbursed for a more efficient provision of healthcare services, i.e. if he/she saves resources on medicines, or does not send the patient for other unnecessary treatments. Thus, for general practitioners, motivation is as follows:

- Transfer of costs besides capitation (sending patients to specialists, closing up practices at 1pm).

- Inducing costs (prescribing medicines rather than spending time with communicating with the patient, i.e. prescribing medicines and diagnostic treatments that might not be necessary)

- Have more insured and less patients

Applying these capitation principles, Slovak general practitioners gain the highest profit when they do not treat any patient. Each treated patients decreases their profits.

Scheme 3: Income, cost and profit curve of a general practitioner in Slovakia

Source: Prepared by the author

7. If we know all this, is there any aim for innovation or solution for changing the situation?

If we all know this, is there any method to change these negative aspects of „simple capitation“?

One of the existing activities to change it is the Plan MEDIPARTNER in Košice (which is administered by the health insurance company ZP Dôvera in cooperation with KlientPRO SK), in which 53 general practitioners operate with an innovative payment mechanism – capitation for bearing the whole risk and taking care of 40 000 insured. Together with 2 hospitals they are responsible for managing costs of this group of insured.

General practitioners are financially responsible for medicines prescribed, for treatments prescribed as well as for inpatient care of patients that they decided about. It is the first payment for general practitioners, in which clinical and financial decision-making go hand-in-hand.

Details of this Plan will be presented in lecture No. 7 by my colleague from HPI and KlientPRO SK Tomáš Szalay.

Summary

- Capitation is a payment „per capita“, the word originates in Latin „caput“ – head

-

Capitation includes 3 important aspects:

- Money follows the insured

- Prospective payment mechanism

- The one who obtains capitation has to bear the financial risk

-

Capitation types:

- Only healthcare services provided by the specific doctor („simple capitation“)

- Capitation for ambulatory care (full physician capitation)

- Full risk capitation

- In Slovakia, „simple capitation“ is the dominant form of capitation

- Simple capitation applied in Slovakia does not reimburse the general practitioner for activity, coordination of healthcare services nor for the result.

-

For general practitioners the following situations are motivators:

- Transfer of costs besides capitation (sending patients to specialists, closing up practices at 1pm).

- Inducing costs (prescribing medicines rather than spending time with communicating with the patient)

- Prescribing more medicines and diagnostic treatments, which might not be necessary

-

The first aim to change this is the Plan MEDIPARTNER:

- General practitioners are financially responsible for medicines prescribed, treatments prescribed as well as for inpatient care that they decided about.

- It is the first payment mechanism for general practitioners, in which clinical and financial decision-making go hand-in-hand.

Bye for now! In the next lecture we will continue with payment mechanisms – reimbursements of specialists and hospitals.

Bibliography

Presentation of Angelika Szalayová

News

The amendment of the Decree on emergency medical service

Health insurance companies returned over 400 thousand €

The HCSA received 1,647 complaints last year

A half million people will earn more

Most of public limited companies ended in the black

Debt of hospitals on premiums has grown to nearly € 105 MM

Slovak health care may miss € 250 million next year

Profits of HIC amounted to € 69 mil. last year

Owners of Dôvera paid out money but did not paid taxes

Like us on Facebook!

Our analyses

- 10 Years of Health Care Reform

- New University Hospital in Bratislava

- Understanding informal patient payments in Kosovo’s healthcare system

- Analysis of waiting times 2013

- Health Policy Basic Frameworks 2014-2016

- Analysis of informal payments in the health sector in Slovakia

- Serbia: Brief health system review

developed by enscope, s.r.o.