—

HPI Network > HPI - Health Policy Institute > Lectures > It’s time to learn from the Dutch masters (lecture 4/8)

It’s time to learn from the Dutch masters (lecture 4/8)

Tuesday, 25. June 2013, 14:11 — HPI

Watch the fourth lecture from 8 lectures course running under the title „Innovation for better healthcare” at University for modern Slovakia. In this lecture, Peter Pažitný explains why is the Dutch Healthcare considered as the best in Europe. The lecture video includes English subtitles. Transcript together with the all schemas can be found under the video.

1. What is EHCI?

European Health Consumer Index (EHCI) ranking:

- Is published by the Swedish organization Health Consumer Powerhouse since 2005

- EHCI 2012 was published again after three years (2009 was the last one before)

- It compares healthcare systems of 34 European countries (the whole EU + Norway, Switzerland, Iceland, Albania, Macedonia, Croatia and in 2012 Serbia for the first time.

- The 2012 winner has been traditionally the Netherlands, followed by Denmark and Iceland.

- The Netherlands won by a wide margin, however, this does not mean that the Dutch healthcare system is the best in Europe.

- The EHCI is ranking about the most acceptable system to the patients.

- The authors of the ranking, however, claim that it is very difficult to build an index comparing healthcare systems, in which the Netherlands would not have at least the bronze rank.

The Dutch victory was highlighted with a recommendation by the authors: „It’s time to learn from the Dutch champions on how to create an efficient healthcare system.“

2. Which healthcare model is applied in the Netherlands?

The Netherlands is the first country in the world, which consistently implements the model of Alain Enthoven based on universal coverage that follows managed competition in the private sector.

3. What does managed competition stand for?

Managed competition of Alain Enthoven is defined as the purchasing strategy with the aim to obtain maximum value for consumers. It applies competition rules derived from microeconomic principles. The key role is held by the sponsor (in case of the Netherlands it is the state), which represents a large number of subscribers, determines the amount of sponsor’s contribution and organizes, structures and sets the health insurance market.

The sponsor (the state) has to:

-

Define the rules of justice:

- Everyone has to be insured and has to be provided with an insurance coverage under attractive conditions

- The insurance company cannot refuse an insured

- A community rating is in place and not a risk rating

-

Choose participating health insurance companies

- Regulates the entry and exit to/from the market

- Defines the operation rules for health insurance companies

-

Manage the process of reinsurance

- Frequency – e.g. once a year

- Rules of reinsurance

-

Create a price elastic demand

- The sponsor’s contribution to the price of the insurance cannot be higher than the lowest price of the insurance

- Supports the definition of standardized packages and products

- Support the dissemination of information about quality

- Supports the choice of health insurance companies on the level of the insured and not his/her employer

-

Manage risk selection

- Obligation to accept all registered insured

- Support standardized packages/products

- Risk compensation – fair distribution of resources among health insurance companies

- Monitor reinsurance practices

- Monitor quality.

4. What does managed competition not stand for?

Managed competition:

- There is no free market. Managed competition uses market forces in an environment with strictly defined rules.

- It is not about people thrown on the market forced to find health insurance. In managed competition systems, the sponsor actively improves the market environment.

- There is no deregulation. It is about the new rules and not any rules.

- It is not about quality reduction. Managed competition supports individual choices.

5. What are the basic principles of health insurance in the Netherlands?

Everyone is obliged to purchase:

- Individual private health insurance

- With a legally prescribed basic benefit package

- From a private health insurance company

The health insurance company is obliged to accept each insured:

- with community rate premiums (it is not an insurance based on individual risk factors)

- without excluding coverage based on existing predispositions (health status, age, gender and so on).

6. How do health insurance companies operate in the Netherlands?

Health insurance companies in the Netherlands are joint stock companies having the possibility to make profits. In 2011, the insured had the chance to choose from 56 different health insurance contracts in 27 health insurance companies. In 2012, the number of health insurance contracts has slightly increased to 59 and the number of health insurance companies decreased to 26. The four largest holdings of health insurance companies in the Netherlands possess 90% of the market. The largest player – Achmea (also the owner of the Slovak health insurance company Union) possesses a market share of 32% in the Netherlands.

7. How do health insurance companies compete with each other?

The competition among health insurance companies occurs in an efficient purchase of healthcare services and administration of the system. Health insurance companies compete with the amount of nominal premiums for the basic benefit package of health insurance and the type of insurance contracts (products), which they offer to the clients.

The insured have the right to change health insurance companies once a year, the contract with the health insurance company is always signed for one year. In 2012, lots of insured changed their health insurance companies – 1 million people in total, equivalent to 6% of all insured.

8. How does health insurance work in the Netherlands?

In the Dutch health insurance system, there are three financial flows:

- social contributions of the employers – 7.1% of the gross wage (19.4 billion € in total) – 49.5% of all resources

- social contributions of the state for children (2.3 billion € in total) – 5.9% of all resources

- nominal premiums (17.5 billion € in total) – 44.6% of all resources

Scheme 1: A simplified model of financial flows of health insurance based on the Health Insurance Act

Source: Schäfer W, Kroneman M, Boerma W, van den Berg M, Westert G, Devillé W, and van Ginneken E. The Netherlands: Health system review. Health Systemsin Transition, 2010; 12(1):1–229.

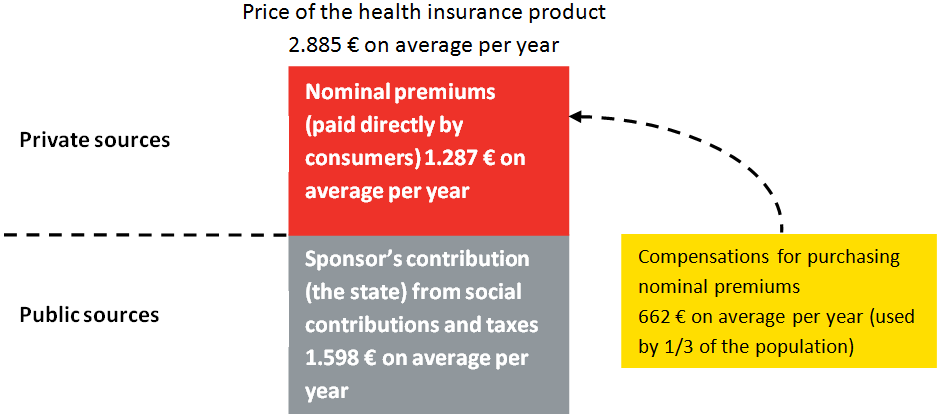

9. Nominal premiums are the price of products of health insurance for consumers

Nominal premiums:

- are innovations, which react on the necessity to engage customers to the decision-making process about the health insurance product.

- are payments, paid in the Netherlands by each insured to his/her health insurance company.

- are differences between sponsors‘ contributions (the state) and price of the health insurance product.

Scheme 2: Nominal premiums in the Netherlands

Source: Prepared by the author

Note: the model is simplified, the amounts stated are approximate

10. How big are the nominal premiums in the Netherlands?

As we have already mentioned, each Dutch persons (besides children up to 18 years) is obliged to get insurance:

- The average amount of nominal premiums in the Netherlands in 2012 was 1.287 EUR per year

- The lowest nominal premiums in 2012 were 1.100 EUR per year.

- The highest nominal premiums in 2012 were 1.350 EUR per year.

Nominal premiums return people the possibility to decide about their health insurance products according to their preferences. As there is competition between the products based on their price, the decisions of consumers are price-sensitive. Expenditures for nominal premiums directly compete with other expenses of households.

In order everybody in the Netherlands can afford to purchase a health insurance product (because that is the objective), the state provides compensation for purchasing nominal premiums. In total, one third of the population uses such compensations, which reach approximately 662 EUR per year.

11. How big are the copayments in the Netherlands?

Each Dutch person has to bear besides nominal premiums a so-called first copayment in the amount of 350 € (for 2013). This first copayment means that the first 350 € (for 2013) are paid by the customer from his/her own pocket. After purchasing healthcare services for the amount of 350 € (cumulatively), the health insurance company starts to bear the costs. These first copayments should discourage people from unnecessary healthcare spending. At the same time, it supports utilization of healthcare services, which are considered by the consumer as valuable.

This copayment may be increased with an additional one, a voluntary copayment, up to 500 €. Thus, total copayments of an individual may reach 850 € in total. Obviously, the higher the first copayment, the lower the premium.

12. What are some concrete examples of health insurance products in the Netherlands?

The health insurance company Agis offers both of the following products. Agis is a brand that belongs to the concern of Achmea, In 2012, it had 5 different health insurance products in its portfolio:

|

|

Pro Life Basispolis Basic |

TakeCareNow Internetbasispolis |

|---|---|---|

|

Target group (for whom the product is meant) |

Strong Christian emphasis focused on life as the greatest value. The product is focused on Christian maternity care, nursing and palliative care. |

Product focused on young people, supported by a suitable web presentation and complementary products. Emphasis is placed on the internet as the main communication tool with the health insurance company. It tries to attract young people also with a wide range of online healthcare products. |

|

Scope of coverage/benefits (other than the legally prescribed basic benefit package) |

The advertisements of this product emphasize that it does not cover abortion, euthanasia and sex reassignment surgery. |

This product enables the access to all Dutch hospitals without prior authorization. |

|

Price of the product in 2012 |

108.25 EUR per month |

The amount of the premium depends on the level of copayment chosen. In case it is zero, the monthly nominal premiums are in the amount of 99.67 EUR. If the insured chooses the highest copayment in the amount of 500 EUR, monthly nominal premiums decrease to 78.84 EUR. |

Source: Mária Pourová, HPI 2013 based on the study on nominal premiums for the General Health Insurance Company (VZP) of the Czech Republic

Summary

- The Netherlands is the winner of EHCI 2012

- In the Netherlands, a healthcare system of managed competition based on the model of Alain Enthoven is at place

- Managed competition by Alain Enthoven is defined as a purchasing strategy with the aim of gaining maximum value for the consumers

- Managed competition does not mean free market. Managed competition utilizes market forces in an environment with strictly defined rules.

- Three principles of health insurance in the Netherlands are: the obligation to purchase health insurance, from a private health insurance company, with a legally prescribed basic benefit package.

- In the Netherlands, there are currently 26 health insurance companies, which offer 59 insurance products

- They compete with the price and the offer of health insurance products according to customers’ preferences

- Nominal premiums make 44.6% of all healthcare resources, the rest is financed from social contributions (49.5%) and taxes (5.9%).

- Nominal premiums are the difference between price of a health insurance product and the sponsor’s contribution.

- The average amount of the insurance is 1.287 € per year, from 1.110 € to 1.350 €. Consumers become very price-sensitive on health insurance products.

- The so called first copayment of the consumer (350 € is obligatory, additional 500 € is voluntary) is an essential part of health insurance products, which limits the utilization of healthcare services that do not bring consumers any value. The higher these copayments, the lower are the nominal premiums.

Bibliography

Enthoven, A. C.: The History and Principles of Managed Competition, Health Affairs, Supplement 1993

European Health Consumer Index 2012 vydaný Health Consumer Powerhouse

Schäfer W, Kroneman M, Boerma W, van den Berg M, Westert G, Devillé W, and van Ginneken E. The Netherlands: Health system review. Health Systemsin Transition, 2010; 12(1):1–229.

Study on nominal premiums for the General Health Insurance Company (VZP) in the Czech Republic conducted by HPI and ReformaZdravotnictví.CZ (with a kind permission of Mária Pourová from HPI, who completed the chapter about nominal premiums in the Netherlands)

News

The amendment of the Decree on emergency medical service

Health insurance companies returned over 400 thousand €

The HCSA received 1,647 complaints last year

A half million people will earn more

Most of public limited companies ended in the black

Debt of hospitals on premiums has grown to nearly € 105 MM

Slovak health care may miss € 250 million next year

Profits of HIC amounted to € 69 mil. last year

Owners of Dôvera paid out money but did not paid taxes

Like us on Facebook!

Our analyses

- 10 Years of Health Care Reform

- New University Hospital in Bratislava

- Understanding informal patient payments in Kosovo’s healthcare system

- Analysis of waiting times 2013

- Health Policy Basic Frameworks 2014-2016

- Analysis of informal payments in the health sector in Slovakia

- Serbia: Brief health system review

developed by enscope, s.r.o.